Recent Mergers and Acquisitions Examples: A Comprehensive Overview

Mergers and acquisitions (M&A) are significant events in the corporate world, reshaping industries and influencing market dynamics. Understanding recent mergers and acquisitions examples is crucial for investors, business professionals, and anyone interested in the strategic moves of major companies. This article will delve into several notable mergers and acquisitions examples from recent years, analyzing their rationale, impact, and potential outcomes.

Understanding Mergers and Acquisitions

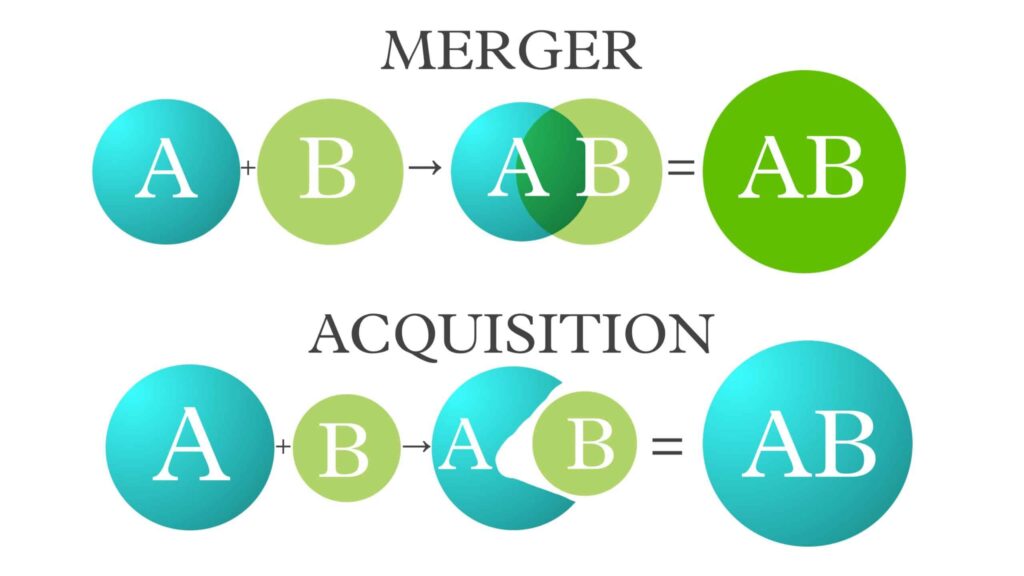

Before examining specific mergers and acquisitions examples, it’s essential to understand the basic concepts. A merger is when two companies combine to form a new entity, while an acquisition is when one company purchases another. Both strategies are used to achieve various goals, such as expanding market share, diversifying product lines, or gaining access to new technologies.

Types of Mergers

- Horizontal Merger: Occurs between companies in the same industry.

- Vertical Merger: Involves companies in the same supply chain.

- Conglomerate Merger: Combines companies in unrelated industries.

Motivations Behind M&A

Companies engage in mergers and acquisitions for numerous strategic reasons. These can include:

- Achieving economies of scale

- Expanding into new markets

- Acquiring new technologies or intellectual property

- Diversifying product or service offerings

- Eliminating competition

Notable Recent Mergers and Acquisitions Examples

Let’s explore some recent mergers and acquisitions examples that have made headlines and significantly impacted their respective industries.

Microsoft’s Acquisition of Activision Blizzard

One of the most significant mergers and acquisitions examples in recent history is Microsoft’s proposed acquisition of Activision Blizzard. This deal, valued at approximately $68.7 billion, aims to bolster Microsoft’s gaming division and provide a strong foothold in the metaverse. Activision Blizzard is a leading game developer known for popular franchises like Call of Duty, World of Warcraft, and Overwatch. This acquisition would bring these titles under the Microsoft umbrella, potentially enhancing its Xbox Game Pass service and expanding its reach in the gaming market. The deal is currently facing regulatory scrutiny from various countries concerned about potential anti-competitive effects. The implications of this particular merger and acquisition are vast, especially when considering the future of gaming and digital entertainment.

AMD’s Acquisition of Xilinx

Another notable example is AMD’s acquisition of Xilinx. This merger and acquisition, valued at around $35 billion, combines AMD’s strength in CPUs and GPUs with Xilinx’s expertise in programmable logic devices (FPGAs). The deal aims to create a high-performance computing powerhouse, capable of competing more effectively with Intel in the data center, automotive, and industrial markets. Xilinx’s FPGAs are used in a wide range of applications, from aerospace and defense to telecommunications and healthcare. Integrating these technologies allows AMD to offer more comprehensive solutions to its customers. This merger and acquisition example highlights the trend of companies seeking to diversify their technological capabilities to meet the evolving demands of the market. [See also: Semiconductor Industry Consolidation Trends]

Broadcom’s Acquisition of VMware

Broadcom’s acquisition of VMware is a significant move in the technology sector. Valued at approximately $61 billion, this merger and acquisition aims to strengthen Broadcom’s position in the enterprise software market. VMware is a leading provider of virtualization and cloud computing infrastructure, enabling businesses to run applications more efficiently and securely. Broadcom’s acquisition of VMware is expected to create synergies between their respective product portfolios and expand their customer base. However, the deal has also raised concerns about potential price increases and reduced innovation. Stakeholders are closely watching how Broadcom will integrate VMware and manage its vast ecosystem of partners and customers. This merger and acquisition example underscores the importance of understanding the potential impacts of large-scale technology deals on the competitive landscape.

Qualcomm’s Acquisition of NUVIA

Qualcomm’s acquisition of NUVIA, a chip design startup, represents a strategic move to enhance its capabilities in the CPU market. NUVIA was founded by former Apple chip architects and has developed high-performance, low-power server CPUs. Qualcomm’s acquisition of NUVIA aims to leverage NUVIA’s expertise to create custom CPUs for its Snapdragon mobile platforms, as well as expand into new markets such as laptops and data centers. This merger and acquisition allows Qualcomm to reduce its reliance on ARM’s standard CPU designs and differentiate its products through custom silicon. This merger and acquisition example highlights the growing importance of in-house chip design capabilities for technology companies seeking to gain a competitive edge. [See also: Future of Mobile Computing]

Elon Musk’s Acquisition of Twitter

Elon Musk’s acquisition of Twitter for $44 billion is a highly publicized and controversial example of a recent merger and acquisition. Musk, the CEO of Tesla and SpaceX, has stated his intention to transform Twitter into a platform for free speech and to unlock its potential. This merger and acquisition has been met with mixed reactions, with some praising Musk’s vision and others expressing concerns about the future of the platform. Musk’s plans for Twitter include reducing content moderation, implementing new features, and increasing transparency. The long-term impact of this acquisition remains to be seen, but it is undoubtedly one of the most closely watched mergers and acquisitions examples in recent years. This acquisition is unique due to the individual nature of the buyer and the public platform being acquired.

HP’s Acquisition of Poly

HP’s acquisition of Poly, a global provider of workplace collaboration and communication solutions, reflects the increasing importance of hybrid work environments. This merger and acquisition combines HP’s strength in personal computing and printing with Poly’s expertise in audio and video conferencing equipment. The deal aims to provide businesses with comprehensive solutions for hybrid work, enabling employees to collaborate effectively regardless of their location. This merger and acquisition example illustrates how companies are adapting to the changing needs of the workforce and investing in technologies that support remote and hybrid work models. The combined entity is positioned to offer a more complete suite of products and services to meet the demands of the modern workplace.

Analyzing the Impact of Mergers and Acquisitions

Mergers and acquisitions can have significant impacts on various stakeholders, including shareholders, employees, customers, and the overall economy. It is crucial to analyze these impacts to understand the potential benefits and risks of M&A activity.

Impact on Shareholders

Shareholders of the acquired company typically benefit from mergers and acquisitions, as they often receive a premium over the current market price of their shares. Shareholders of the acquiring company may also benefit if the acquisition creates synergies and increases shareholder value. However, there is also a risk that the acquisition may not be successful and could negatively impact the acquiring company’s stock price.

Impact on Employees

Mergers and acquisitions can have a significant impact on employees, both positive and negative. On the positive side, acquisitions can create new opportunities for career advancement and skill development. On the negative side, they can lead to job losses, particularly in areas where there is overlap between the two companies. It is important for companies to manage the integration process carefully to minimize the negative impact on employees and maintain morale. [See also: Managing Employee Morale During Mergers]

Impact on Customers

Mergers and acquisitions can also affect customers. In some cases, they can lead to improved products and services, as the combined company has access to a broader range of resources and expertise. However, they can also lead to higher prices and reduced competition, particularly if the acquisition eliminates a major competitor. Regulatory agencies often scrutinize mergers and acquisitions to ensure that they do not harm consumers.

The Role of Regulatory Agencies

Regulatory agencies play a crucial role in overseeing mergers and acquisitions to ensure that they do not violate antitrust laws or harm competition. Agencies such as the U.S. Federal Trade Commission (FTC) and the European Commission (EC) review proposed mergers and acquisitions to assess their potential impact on the market. If the agencies determine that a merger and acquisition would likely harm competition, they may block the deal or require the companies to make concessions, such as divesting certain assets. The scrutiny of regulatory agencies can significantly influence the outcome of mergers and acquisitions, as seen in the case of Microsoft’s acquisition of Activision Blizzard.

Conclusion

Mergers and acquisitions are a dynamic and complex aspect of the corporate world. Examining recent mergers and acquisitions examples provides valuable insights into the strategic motivations of companies, the potential impacts on stakeholders, and the role of regulatory agencies. From Microsoft’s ambitious move into gaming to Elon Musk’s takeover of Twitter, these deals reshape industries and influence the competitive landscape. Understanding these trends is essential for anyone seeking to navigate the ever-evolving world of business and finance. By keeping abreast of recent mergers and acquisitions examples, investors, professionals, and observers can better anticipate future developments and make informed decisions.