Navigating the Landscape of Employee Benefits Vendors: A Comprehensive Guide

In today’s competitive job market, offering a robust and attractive employee benefits package is no longer a perk; it’s a necessity. Companies that prioritize employee well-being and financial security attract and retain top talent, fostering a more engaged and productive workforce. However, managing employee benefits can be complex, requiring expertise in areas like healthcare, retirement planning, and wellness programs. This is where employee benefits vendors come into play. Choosing the right employee benefits vendors is a critical decision that can significantly impact employee satisfaction and your company’s bottom line. This comprehensive guide will help you navigate the landscape of employee benefits vendors, providing insights into different types of vendors, key considerations for selection, and best practices for implementation.

Understanding the Role of Employee Benefits Vendors

Employee benefits vendors are third-party organizations that provide services related to the design, administration, and management of employee benefits programs. They act as intermediaries between employers and insurance companies, healthcare providers, and other benefits-related service providers. By outsourcing these functions to specialized employee benefits vendors, companies can streamline their HR operations, reduce administrative burdens, and gain access to expertise they may not have in-house.

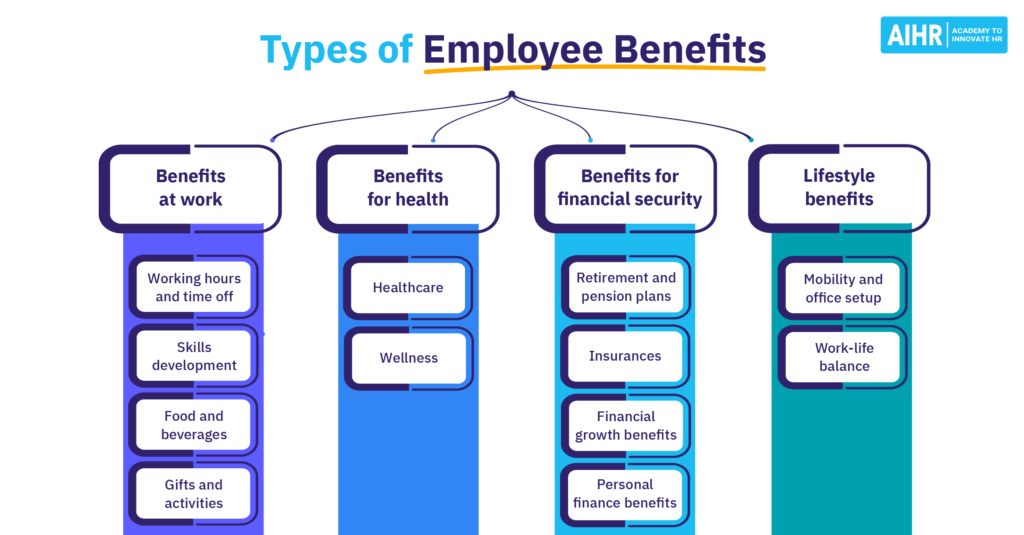

Types of Employee Benefits Vendors

The landscape of employee benefits vendors is diverse, with different vendors specializing in various aspects of benefits management. Here’s a breakdown of some common types:

- Health Insurance Brokers: These vendors help companies find and negotiate health insurance plans for their employees. They work with multiple insurance carriers to compare coverage options, pricing, and network access.

- Benefits Administration Platforms: These platforms provide a centralized system for managing employee benefits enrollment, eligibility, and communication. They often integrate with payroll and HR systems to automate administrative tasks.

- Retirement Plan Providers: These vendors offer 401(k) plans, pensions, and other retirement savings options for employees. They handle investment management, recordkeeping, and compliance.

- Wellness Program Providers: These vendors offer programs designed to promote employee health and well-being, such as fitness challenges, health screenings, and mental health resources.

- Specialty Benefits Providers: These vendors offer niche benefits, such as dental insurance, vision insurance, life insurance, disability insurance, and employee assistance programs (EAPs).

Key Considerations When Selecting Employee Benefits Vendors

Choosing the right employee benefits vendors requires careful consideration of your company’s specific needs, budget, and employee demographics. Here are some key factors to keep in mind:

Assess Your Needs and Objectives

Before you start evaluating employee benefits vendors, take the time to assess your company’s current benefits offerings and identify any gaps or areas for improvement. Consider your employees’ needs and preferences, as well as your company’s budget and strategic goals. What are your priorities – cost containment, employee satisfaction, or attracting top talent? Clearly defining your objectives will help you narrow down your options and choose vendors that align with your goals. [See also: Conducting an Employee Benefits Audit]

Evaluate Vendor Expertise and Experience

Look for employee benefits vendors with a proven track record of success. Check their credentials, certifications, and years of experience in the industry. Ask for references from other clients and inquire about their experience working with companies of similar size and industry. A vendor with deep expertise and experience will be better equipped to handle complex benefits issues and provide valuable insights.

Consider Technology and Integration Capabilities

In today’s digital age, technology plays a crucial role in benefits administration. Choose employee benefits vendors that offer user-friendly technology platforms that streamline enrollment, communication, and reporting. Ensure that the vendor’s technology integrates seamlessly with your existing HR and payroll systems. A well-integrated technology platform can significantly reduce administrative burdens and improve the employee experience. [See also: The Role of Technology in Employee Benefits Administration]

Assess Vendor Service and Support

Excellent customer service and support are essential when working with employee benefits vendors. Choose vendors that provide responsive and knowledgeable support to both your HR team and your employees. Inquire about their service level agreements (SLAs) and response times. A vendor that provides proactive support and timely assistance can help you resolve issues quickly and minimize disruptions.

Compare Pricing and Fees

Obtain quotes from multiple employee benefits vendors and compare their pricing structures. Understand the fees associated with each vendor’s services, including administrative fees, enrollment fees, and consulting fees. Don’t just focus on the lowest price; consider the value and quality of the services offered. A vendor that offers comprehensive services and excellent support may be worth the extra investment. Remember that the cheapest option isn’t always the best, especially when dealing with something as important as employee benefits. [See also: Negotiating Employee Benefits Vendor Contracts]

Ensure Compliance and Security

Employee benefits vendors must comply with various federal and state regulations, such as HIPAA, ERISA, and COBRA. Choose vendors that have a strong track record of compliance and data security. Inquire about their security protocols and data privacy policies. A vendor that prioritizes compliance and security can help you avoid costly penalties and protect your employees’ sensitive information.

Best Practices for Implementing Employee Benefits Programs with Vendors

Once you’ve selected your employee benefits vendors, it’s important to implement your benefits programs effectively. Here are some best practices to follow:

Communicate Clearly and Effectively

Communicate the details of your benefits programs clearly and effectively to your employees. Use a variety of communication channels, such as email, newsletters, and employee meetings, to ensure that employees understand their benefits options and how to enroll. Provide clear and concise information about plan coverage, eligibility requirements, and enrollment deadlines. [See also: Effective Employee Benefits Communication Strategies]

Provide Employee Training and Education

Offer training and education sessions to help employees understand their benefits and make informed decisions. Invite your employee benefits vendors to participate in these sessions and answer employee questions. Provide resources such as online tutorials and FAQs to support employee learning.

Monitor Vendor Performance

Regularly monitor the performance of your employee benefits vendors to ensure that they are meeting your expectations. Track key metrics such as employee satisfaction, enrollment rates, and claims processing times. Hold regular meetings with your vendors to discuss performance issues and identify areas for improvement. [See also: Key Performance Indicators for Employee Benefits Programs]

Regularly Review and Update Your Benefits Programs

Employee needs and market conditions change over time. Regularly review and update your benefits programs to ensure that they remain competitive and meet the evolving needs of your workforce. Solicit feedback from employees and consider conducting employee surveys to gather insights. Work with your employee benefits vendors to identify opportunities to enhance your benefits offerings and improve employee satisfaction.

Leverage Data and Analytics

Many employee benefits vendors offer data and analytics tools that can provide valuable insights into employee health, wellness, and benefits utilization. Leverage these tools to identify trends, track program effectiveness, and make data-driven decisions. For example, you can use data to identify employees at risk for chronic diseases and target wellness programs accordingly.

The Future of Employee Benefits Vendors

The landscape of employee benefits vendors is constantly evolving, driven by technological advancements, changing employee expectations, and increasing regulatory complexity. Here are some trends to watch:

- Increased Focus on Personalized Benefits: Employees are increasingly demanding personalized benefits that meet their individual needs and preferences. Employee benefits vendors are responding by offering more flexible and customizable benefits options.

- Growth of Digital Health Solutions: Digital health solutions, such as telehealth and virtual mental health services, are becoming increasingly popular. Employee benefits vendors are integrating these solutions into their offerings to provide employees with convenient and accessible healthcare options.

- Emphasis on Financial Wellness: Financial stress can have a significant impact on employee productivity and well-being. Employee benefits vendors are offering financial wellness programs to help employees manage their finances and achieve their financial goals.

- Greater Use of Artificial Intelligence (AI): AI is being used to automate benefits administration tasks, personalize employee communication, and improve decision-making. Employee benefits vendors are leveraging AI to enhance their services and provide a better employee experience.

Conclusion

Choosing the right employee benefits vendors is a critical decision that can significantly impact your company’s ability to attract and retain top talent. By carefully assessing your needs, evaluating vendor expertise, and implementing best practices, you can create a benefits program that meets the needs of your employees and supports your company’s strategic goals. In today’s competitive landscape, a well-designed and effectively managed benefits program is a key differentiator that can help you attract and retain the best employees. Remember to continuously monitor vendor performance and adapt your benefits strategy to meet the evolving needs of your workforce. By partnering with the right employee benefits vendors, you can create a benefits program that enhances employee well-being, boosts productivity, and contributes to your company’s overall success.