Financial Data Aggregation Companies: Streamlining Insights and Transforming Industries

In today’s fast-paced financial landscape, access to timely and accurate data is paramount. Financial data aggregation companies have emerged as key players, revolutionizing how individuals, businesses, and institutions manage and utilize financial information. These companies specialize in collecting, consolidating, and standardizing financial data from various sources, providing a unified view that enables informed decision-making. The rise of financial data aggregation reflects a growing need for efficiency, transparency, and personalized financial solutions. This article will delve into the world of financial data aggregation companies, exploring their functionalities, benefits, challenges, and impact across different sectors.

Understanding Financial Data Aggregation

At its core, financial data aggregation involves gathering financial information from multiple sources and presenting it in a single, easily accessible format. These sources can include bank accounts, credit cards, investment portfolios, loan accounts, and even alternative financial platforms. Financial data aggregation companies leverage technology to connect to these diverse sources, often using APIs (Application Programming Interfaces) and secure data transfer protocols to ensure data integrity and security. The aggregated data is then standardized and categorized, allowing users to gain a comprehensive overview of their financial situation.

The Process of Data Aggregation

- Data Collection: Establishing secure connections with various financial institutions and platforms.

- Data Extraction: Retrieving relevant financial data, such as account balances, transaction histories, and investment holdings.

- Data Standardization: Converting data into a consistent format, resolving discrepancies, and categorizing transactions.

- Data Presentation: Displaying the aggregated data in a user-friendly interface, often through dashboards, reports, or mobile apps.

Key Benefits of Financial Data Aggregation

The adoption of financial data aggregation solutions offers numerous advantages for both individuals and organizations:

- Improved Financial Visibility: Gain a holistic view of your financial situation, eliminating the need to manually track multiple accounts.

- Enhanced Budgeting and Planning: Analyze spending patterns, identify areas for improvement, and create more effective budgets.

- Streamlined Financial Management: Simplify tasks such as bill payment, investment tracking, and tax preparation.

- Personalized Financial Advice: Enable financial advisors to provide more tailored recommendations based on a complete understanding of your financial profile.

- Fraud Detection and Prevention: Monitor transactions for suspicious activity and detect potential fraud in real-time.

Leading Financial Data Aggregation Companies

Several companies have emerged as leaders in the financial data aggregation space, each offering unique features and capabilities. These companies play a crucial role in connecting consumers and businesses to their financial data.

Plaid

Plaid is one of the most well-known financial data aggregation companies, providing a platform that connects apps and services to users’ bank accounts. It is widely used by fintech companies and developers to build innovative financial solutions. Plaid focuses on secure data transfer and a seamless user experience. [See also: Plaid Security Measures]

Finicity

Finicity, a subsidiary of Mastercard, offers a comprehensive suite of financial data aggregation and insights solutions. It provides access to a wide range of financial data sources and specializes in credit decisioning, personal financial management, and payment solutions. Finicity emphasizes data accuracy and reliability.

Yodlee

Yodlee, now part of Envestnet, is a veteran in the financial data aggregation industry. It provides a platform for accessing and analyzing financial data from thousands of sources. Yodlee’s solutions are used by financial institutions, fintech companies, and wealth management firms. They offer advanced analytics and data enrichment capabilities.

MX

MX focuses on empowering financial institutions and fintech companies with clean and reliable financial data. They offer a platform for data aggregation, enhancement, and connectivity. MX emphasizes data security and privacy, and they offer solutions for personal financial management, fraud detection, and account verification.

Challenges and Considerations

While financial data aggregation offers significant benefits, it also presents certain challenges and considerations:

- Data Security and Privacy: Ensuring the secure storage and transmission of sensitive financial data is paramount. Financial data aggregation companies must implement robust security measures to protect against data breaches and unauthorized access.

- Data Accuracy and Reliability: Maintaining the accuracy and reliability of aggregated data is crucial for informed decision-making. Companies must employ sophisticated data validation and cleansing techniques.

- Data Access and Connectivity: Establishing and maintaining connections with a wide range of financial institutions and platforms can be complex and challenging. Standardized APIs and data transfer protocols are essential.

- Regulatory Compliance: Financial data aggregation companies must comply with various regulations related to data privacy, security, and consumer protection, such as GDPR and CCPA.

- User Consent and Transparency: Obtaining explicit user consent for data aggregation and ensuring transparency about how data is used are crucial for building trust.

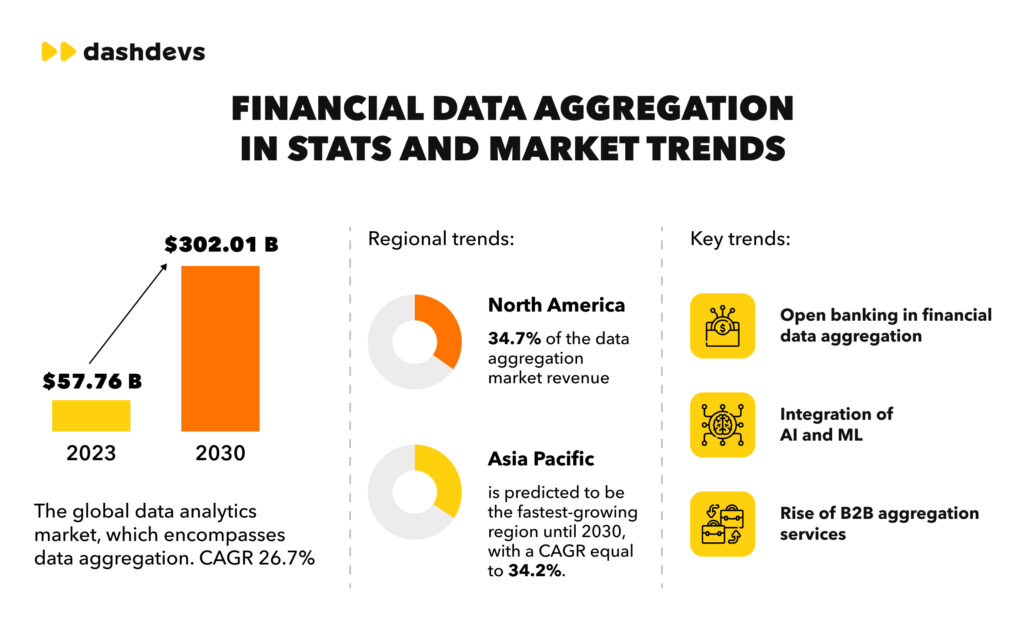

The Future of Financial Data Aggregation

The future of financial data aggregation is bright, with ongoing advancements in technology and increasing demand for personalized financial solutions. Several trends are shaping the evolution of this industry:

- Open Banking: The rise of open banking initiatives is promoting greater data sharing and interoperability between financial institutions, making it easier for financial data aggregation companies to access and integrate data.

- AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) are being used to enhance data analysis, personalize financial insights, and automate financial management tasks.

- Embedded Finance: Financial data aggregation is playing a key role in enabling embedded finance, where financial services are integrated into non-financial platforms and applications.

- Alternative Data Sources: Companies are increasingly exploring alternative data sources, such as social media activity and e-commerce transactions, to gain a more comprehensive understanding of consumer behavior and financial risk.

- Increased Focus on Security: With growing concerns about data breaches and cyberattacks, financial data aggregation companies are investing heavily in security measures and data protection technologies.

Impact Across Industries

Financial data aggregation is transforming various industries, including:

Personal Finance

Individuals can use financial data aggregation tools to track their spending, manage their budgets, and plan for their financial future. These tools provide a consolidated view of all their accounts, making it easier to make informed decisions.

Banking and Financial Services

Banks and financial institutions can use financial data aggregation to improve customer service, personalize product offerings, and detect fraud. By understanding their customers’ financial behavior, they can offer more relevant and targeted services.

Fintech

Fintech companies rely heavily on financial data aggregation to power their innovative financial solutions. These solutions include budgeting apps, investment platforms, and lending services.

Accounting and Tax Preparation

Accountants and tax professionals can use financial data aggregation to streamline the process of gathering financial information from clients. This saves time and reduces the risk of errors.

Conclusion

Financial data aggregation companies are revolutionizing the way individuals and organizations manage and utilize financial information. By providing a unified view of financial data from multiple sources, these companies are enabling informed decision-making, improving efficiency, and driving innovation across various industries. While challenges related to data security, accuracy, and compliance remain, the future of financial data aggregation is promising, with ongoing advancements in technology and increasing demand for personalized financial solutions. As the financial landscape continues to evolve, financial data aggregation will play an increasingly vital role in shaping the future of finance. The benefits of financial data aggregation are clear: better insights, streamlined processes, and improved financial outcomes. Understanding the role of these companies is essential for anyone navigating the complexities of modern finance. Choosing the right financial data aggregation partner depends on specific needs and priorities, but the potential for positive impact is undeniable.