AML Screening Service: Protecting Your Business from Financial Crime

In today’s globalized and interconnected world, businesses face an increasing risk of being used for money laundering and terrorist financing. To combat this threat, Anti-Money Laundering (AML) regulations have become increasingly stringent, requiring businesses to implement robust compliance programs. A crucial component of any effective AML program is an AML screening service. This article delves into the importance of AML screening services, how they work, and what businesses should consider when choosing a provider.

Understanding AML and the Need for Screening

Anti-Money Laundering (AML) refers to a set of laws, regulations, and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Money laundering can have devastating consequences, fueling organized crime, terrorism, and corruption. Governments worldwide have implemented AML regulations to combat these activities and protect the integrity of the financial system.

AML screening services play a vital role in helping businesses comply with these regulations. They involve checking customers, vendors, and other parties against various databases and watchlists to identify potential risks. These databases typically include:

- Sanctions lists: Lists issued by governments and international organizations that identify individuals and entities subject to sanctions.

- Politically Exposed Persons (PEPs) lists: Lists of individuals who hold prominent public functions and are therefore considered to be at higher risk of bribery and corruption.

- Adverse media: News articles and other media reports that may indicate involvement in criminal activity.

How AML Screening Services Work

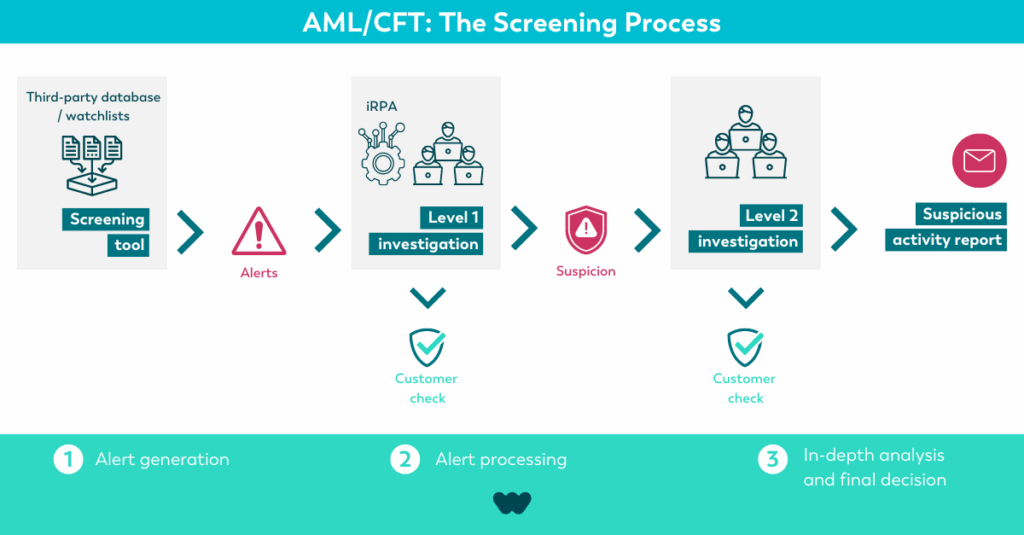

An AML screening service typically involves the following steps:

- Data Input: The business provides the screening service with the names and other relevant information of the individuals or entities they want to screen.

- Database Search: The screening service searches its databases and watchlists for matches against the provided information.

- Match Identification: The screening service identifies potential matches based on name, date of birth, location, and other factors.

- Risk Assessment: The screening service assesses the risk associated with each match, taking into account the severity of the potential offense and the likelihood of the match being accurate.

- Reporting and Escalation: The screening service provides the business with a report of the screening results, highlighting any potential risks. High-risk matches are typically escalated for further investigation.

Benefits of Using an AML Screening Service

Implementing an AML screening service offers numerous benefits to businesses, including:

- Compliance with regulations: Helps businesses comply with AML regulations and avoid costly penalties.

- Reduced risk of financial crime: Reduces the risk of being used for money laundering and terrorist financing.

- Enhanced reputation: Enhances the business’s reputation as a responsible and ethical organization.

- Improved efficiency: Automates the screening process, saving time and resources.

- Comprehensive coverage: Provides access to a wide range of databases and watchlists, ensuring comprehensive screening.

Choosing the Right AML Screening Service Provider

Selecting the right AML screening service provider is crucial for ensuring the effectiveness of your AML program. Consider the following factors when making your decision:

Data Coverage

Ensure the provider has access to a comprehensive range of databases and watchlists, including sanctions lists, PEP lists, and adverse media sources. The more comprehensive the data coverage, the more effectively you can identify potential risks. Look for providers that update their databases frequently to reflect the latest changes in regulations and criminal activity. [See also: Importance of KYC Compliance]

Accuracy

The screening service should be accurate and reliable, minimizing false positives and false negatives. False positives can waste time and resources investigating individuals or entities who pose no actual risk, while false negatives can allow high-risk individuals or entities to slip through the cracks. Ask the provider about their accuracy rates and the measures they take to ensure data quality.

Technology and Integration

The screening service should be easy to use and integrate with your existing systems. Look for providers that offer flexible integration options, such as APIs or web-based interfaces. The technology should be scalable and able to handle your growing screening needs. Consider the user interface and reporting capabilities of the platform. A user-friendly interface will make it easier for your compliance team to manage the screening process and generate reports.

Customization

The screening service should be customizable to meet your specific business needs. Different businesses face different AML risks, so it’s important to choose a provider that can tailor the screening process to your specific requirements. Consider whether the provider allows you to customize the risk scoring criteria, screening thresholds, and reporting formats. Some providers offer more advanced customization options, such as the ability to create custom watchlists or integrate with your own internal databases.

Compliance Expertise

The provider should have a deep understanding of AML regulations and best practices. Choose a provider that has a team of compliance experts who can provide guidance and support. Ask about their experience in your industry and their knowledge of the latest regulatory changes. A provider with strong compliance expertise can help you navigate the complex AML landscape and ensure that your program is effective. [See also: Latest AML Regulations]

Reporting and Audit Trail

The screening service should provide comprehensive reporting and audit trail capabilities. You should be able to easily generate reports that demonstrate your compliance with AML regulations. The audit trail should track all screening activity, including who performed the screening, when it was performed, and the results of the screening. This information is essential for demonstrating due diligence and responding to regulatory inquiries.

Cost and Value

Consider the cost of the screening service in relation to the value it provides. While cost is an important factor, it should not be the only consideration. Choose a provider that offers a good balance of price, features, and support. Be sure to compare the pricing models of different providers, as some may charge per screening, while others may offer subscription-based pricing. Consider the long-term cost of ownership, including implementation costs, training costs, and ongoing maintenance costs. An effective AML screening service is an investment, but the return on investment is significant in terms of risk mitigation and regulatory compliance.

The Future of AML Screening

The field of AML screening is constantly evolving, driven by technological advancements and changes in the regulatory landscape. Artificial intelligence (AI) and machine learning (ML) are playing an increasingly important role in AML screening, enabling businesses to automate the screening process, improve accuracy, and detect more sophisticated forms of money laundering. [See also: AI in AML Compliance]

Looking ahead, we can expect to see:

- Increased use of AI and ML: AI and ML will be used to analyze large datasets and identify patterns that are indicative of money laundering.

- Greater focus on real-time screening: Businesses will need to screen transactions in real-time to prevent money laundering from occurring in the first place.

- Enhanced data privacy: Businesses will need to ensure that they are protecting the privacy of their customers’ data while also complying with AML regulations.

- More collaboration between businesses and regulators: Businesses and regulators will need to work together to combat money laundering effectively.

Conclusion

An AML screening service is an essential tool for businesses of all sizes that are looking to protect themselves from financial crime and comply with AML regulations. By choosing the right provider and implementing a robust screening program, businesses can reduce their risk of being used for money laundering and terrorist financing, enhance their reputation, and improve their overall compliance posture. The proactive adoption of an AML screening service is not merely a regulatory requirement but a strategic imperative for safeguarding business interests in an increasingly complex and regulated world. By carefully considering the factors outlined in this article, businesses can make informed decisions and select an AML screening service that aligns with their specific needs and contributes to a safer and more secure financial ecosystem. Leveraging a robust AML screening service ensures adherence to global regulatory standards, fortifies defenses against financial crimes, and protects the integrity of business operations. The right AML screening service is a cornerstone of proactive risk management, providing businesses with the tools and insights necessary to navigate the complexities of the modern financial landscape. In conclusion, investing in a comprehensive AML screening service is an investment in the long-term health and stability of your business. The continuous evolution of financial crime necessitates an equally dynamic and adaptable approach to AML screening, making it a critical component of responsible business practices.