Risk Analytics: Navigating Uncertainty with Data-Driven Insights

In today’s volatile business landscape, understanding and mitigating risk is paramount. Risk analytics emerges as a critical discipline, leveraging data, statistical algorithms, and technology to identify, assess, and manage potential threats and opportunities. This article delves into the core principles of risk analytics, its applications across various industries, and the benefits it offers to organizations seeking to thrive in an uncertain world. Risk analytics allows for the identification of patterns and trends that would be impossible to see using traditional methods. Businesses can then prepare for upcoming risks before they become major issues. It’s vital to understand this field and how it can help.

Understanding Risk Analytics

Risk analytics is more than just a buzzword; it’s a sophisticated approach to decision-making. It involves collecting and analyzing vast amounts of data from diverse sources – financial statements, market trends, operational data, and even social media – to create a comprehensive picture of an organization’s risk profile. This data is then processed using statistical models, machine learning algorithms, and visualization techniques to identify potential risks, quantify their impact, and develop strategies for mitigation.

At its core, risk analytics aims to answer key questions such as:

- What are the potential risks facing the organization?

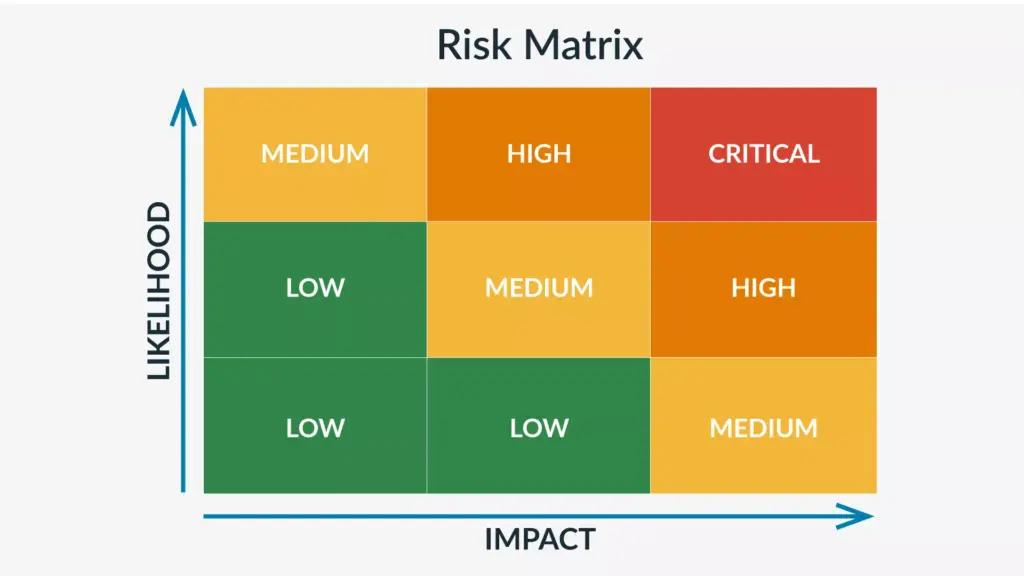

- What is the likelihood of these risks occurring?

- What would be the potential impact of these risks?

- How can we mitigate these risks and minimize their impact?

By providing data-driven answers to these questions, risk analytics empowers organizations to make more informed decisions, allocate resources effectively, and protect their bottom line. Organizations can better understand their risk appetite and align their risk management strategies accordingly. Effective risk analytics programs require buy-in from all levels of the organization.

Key Components of Risk Analytics

A robust risk analytics framework typically encompasses the following key components:

Data Collection and Management

The foundation of any successful risk analytics program is high-quality data. Organizations need to collect data from a variety of sources, both internal and external, and ensure that it is accurate, consistent, and readily accessible. This often involves investing in data management infrastructure and processes to cleanse, transform, and store data effectively. [See also: Data Governance Best Practices]

Statistical Modeling and Machine Learning

Risk analytics relies heavily on statistical modeling and machine learning techniques to identify patterns, predict outcomes, and assess risk. Common techniques include regression analysis, time series analysis, Monte Carlo simulation, and machine learning algorithms such as decision trees, neural networks, and support vector machines. These models can be used to forecast potential losses, identify key risk drivers, and assess the effectiveness of risk mitigation strategies.

Risk Visualization and Reporting

Effective communication is crucial for successful risk analytics. Organizations need to be able to visualize and report risk information in a clear and concise manner, so that stakeholders can understand the potential risks and make informed decisions. This often involves using dashboards, charts, and other visualization tools to present risk data in an easily digestible format. Reports should be tailored to the specific needs of different stakeholders, providing them with the information they need to manage risk effectively. This helps the organization in making better decisions related to risk analytics.

Risk Monitoring and Control

Risk analytics is not a one-time exercise; it’s an ongoing process. Organizations need to continuously monitor their risk profile, track key risk indicators, and adjust their risk mitigation strategies as needed. This requires establishing robust risk monitoring and control processes, as well as developing a culture of risk awareness throughout the organization. Regular audits and reviews can help to ensure that risk management processes are effective and that risks are being managed appropriately. Having a consistent audit strategy is an important part of risk analytics.

Applications of Risk Analytics Across Industries

Risk analytics has a wide range of applications across various industries, including:

Financial Services

In the financial services industry, risk analytics is used to assess credit risk, market risk, operational risk, and regulatory risk. Banks and other financial institutions use risk analytics to make lending decisions, manage their investment portfolios, and comply with regulatory requirements. Fraud detection is another key application, with risk analytics used to identify and prevent fraudulent transactions. [See also: The Future of Fintech Risk Management]

Insurance

Insurance companies use risk analytics to assess underwriting risk, pricing risk, and claims risk. They use statistical models to predict the likelihood of claims, set premiums, and manage their reserves. Risk analytics is also used to detect fraudulent claims and identify high-risk policyholders. Predictive modeling is a key component of risk analytics in the insurance industry.

Healthcare

In the healthcare industry, risk analytics is used to improve patient safety, reduce healthcare costs, and prevent fraud and abuse. Hospitals and other healthcare providers use risk analytics to identify patients at risk of developing complications, prevent medical errors, and optimize resource allocation. Risk analytics is also used to detect fraudulent billing practices and prevent waste and abuse. The use of risk analytics can lead to better patient outcomes.

Supply Chain Management

Organizations use risk analytics to identify and mitigate risks in their supply chains, such as disruptions caused by natural disasters, political instability, or supplier failures. They use risk analytics to assess the vulnerability of their supply chains, identify critical suppliers, and develop contingency plans. Risk analytics can help to improve supply chain resilience and reduce the impact of disruptions. Analyzing the data of your supply chain is an important part of risk analytics.

Retail

Retailers use risk analytics to manage inventory, optimize pricing, and prevent fraud. They use statistical models to forecast demand, optimize inventory levels, and identify pricing opportunities. Risk analytics is also used to detect fraudulent transactions, prevent shoplifting, and manage credit risk. Improved inventory management is a key benefit of using risk analytics.

Benefits of Implementing Risk Analytics

The benefits of implementing risk analytics are numerous and far-reaching. Some of the key benefits include:

- Improved decision-making: Risk analytics provides data-driven insights that enable organizations to make more informed decisions.

- Reduced losses: By identifying and mitigating potential risks, risk analytics can help organizations to reduce losses and protect their bottom line.

- Enhanced regulatory compliance: Risk analytics can help organizations to comply with regulatory requirements and avoid penalties.

- Improved operational efficiency: By optimizing resource allocation and streamlining processes, risk analytics can help organizations to improve operational efficiency.

- Competitive advantage: Organizations that effectively use risk analytics can gain a competitive advantage by making better decisions and managing risk more effectively.

Challenges of Implementing Risk Analytics

Despite the numerous benefits, implementing risk analytics can be challenging. Some of the key challenges include:

- Data quality: The success of risk analytics depends on the quality of the data. Organizations need to ensure that their data is accurate, consistent, and readily accessible.

- Lack of expertise: Risk analytics requires specialized skills and expertise. Organizations may need to invest in training or hire experts to implement and manage their risk analytics programs.

- Organizational culture: Implementing risk analytics requires a culture of risk awareness and collaboration. Organizations need to foster a culture where risk is openly discussed and managed proactively.

- Integration with existing systems: Integrating risk analytics with existing systems can be complex and time-consuming. Organizations need to plan carefully and invest in the necessary integration infrastructure.

- Cost: Implementing risk analytics can be expensive. Organizations need to carefully weigh the costs and benefits before investing in risk analytics programs.

The Future of Risk Analytics

The future of risk analytics is bright. As data becomes more readily available and analytical techniques become more sophisticated, risk analytics will become even more powerful and pervasive. Some of the key trends shaping the future of risk analytics include:

- Increased use of artificial intelligence (AI) and machine learning (ML): AI and ML are being used to automate risk assessment, improve prediction accuracy, and identify new risks.

- Greater emphasis on real-time risk analytics: Organizations are increasingly demanding real-time insights into their risk profile, so that they can respond quickly to emerging threats.

- Integration of risk analytics with other business functions: Risk analytics is becoming increasingly integrated with other business functions, such as finance, operations, and marketing.

- Adoption of cloud-based risk analytics solutions: Cloud-based solutions are making risk analytics more accessible and affordable for organizations of all sizes.

- Focus on cyber risk analytics: With the increasing threat of cyberattacks, organizations are investing heavily in cyber risk analytics to protect their data and systems.

Conclusion

Risk analytics is a critical discipline for organizations seeking to navigate uncertainty and thrive in today’s volatile business landscape. By leveraging data, statistical algorithms, and technology, risk analytics empowers organizations to identify, assess, and manage potential threats and opportunities. While implementing risk analytics can be challenging, the benefits are numerous and far-reaching. As data becomes more readily available and analytical techniques become more sophisticated, risk analytics will become even more powerful and pervasive, helping organizations to make better decisions, reduce losses, and gain a competitive advantage. Embracing risk analytics is no longer a luxury, but a necessity for organizations seeking to succeed in the 21st century.